Along the 40-minute drive from Stanford’s quad to NVIDIA’s neon-green HQ, lab benches become unicorn boards at break-neck speed. Silicon Valley’s feedback loop — talent, capital, compute, repeat — has never spun faster: AI chips double in power every twelve months, cloud budgets keep climbing, and regulators are green-lighting data-driven medicine, logistics, and design. Investors who can bridge that garage-to-global gap stand to capture the next generation of outliers before their tickers hit the tape.

Introducing Strata:

Venture Science’s innovative fund capturing outsized returns at the crossroads of private-market innovation and public-market inflection.

Why Now?

AI’s super-cycle is compressing private timelines — start-ups reach IPO scale faster than ever.

$4 trillion market caps (see Nvidia) show public multiples can still expand when growth narratives ring true.

Rate volatility is sidelining passive capital; agile, thesis-driven investors can step into mis-priced openings.

How Strata Creates Edge

-

Located in the SF Bay Area, we’re shoulder-to-shoulder with the engineers and founders shaping the Valley’s next wave of AI breakouts. That day-to-day proximity gives Strata first-look allocations into oversubscribed late-stage rounds long before the wider market even sees a term sheet.

-

For more than a decade we’ve complemented traditional diligence with a disciplined layer of quantitative signals. Our framework guides both position sizing and exit timing, grounding decisions in observable market activity rather than headlines.

-

Strata offers investors annual liquidity windows, delivering flexibility that traditional venture funds—often locked up for a decade or more—simply don’t provide.

Snapshot · Recent Trade Example

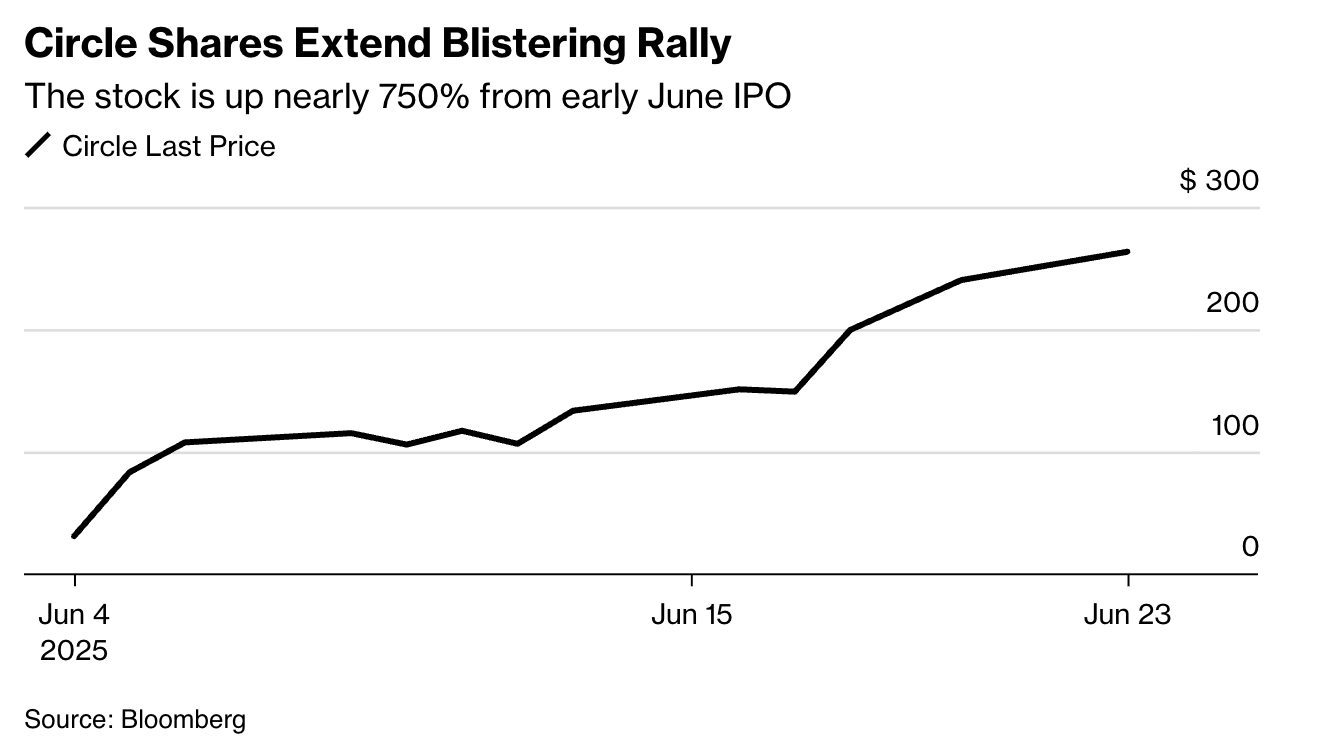

Circle (CRCL) — Early private participation in 2018; IPO allocation June 2025 at $31/share; exited core position at $247/share, retaining upside via earlier SPV.

Net multiple to date: 8× (partially realized). See methodology in full presentation.

Dig Deeper?

Access our full page deck detailing strategy and track record.