Seeking Returns in Times of Uncertainty

The only certainty in today's global environment is that uncertainty reigns. Geopolitical turmoil, ongoing inflation, energy crises, and leading indicators of a budding recession create a storm of investment insecurity. Central banks in the US and globally are struggling to stabilize inflation. Equity markets remain turbulent against a backdrop of the US Federal Reserve’s iterative 75 BPS monthly interest rate increases. Currencies in Europe, the UK, and other countries continue to lose value against the US dollar with little relief. Experts expect continued market volatility to be the theme of the remainder of 2022, with an increasingly sluggish economy reinforcing the malaise. Even typically positive harbingers like a robust real estate market and strong labor pool aren’t the beneficial economic variables they appear to be. Both mask undergirding economic turbulence as the former prices middle-class Americans out of home ownership, and the latter directly contributes to rising inflation by increasing demand against struggling supplies.

Against this landscape, investors struggle to find safe havens for their capital and continually seek investments to withstand market turbulence and generate alpha to defeat inflation.

The bull market of the past decade amplifies the complexity of today's bear market by serving as a stark contrast. Many independent investors are adrift with plunging net worth as stocks fluctuate and the rising interest rates drive real estate values down. Financial advisors are hard-pressed to deliver superior returns to their clients while reassuring those who've never experienced volatility as we see today.

Because of this volatility and doubt, alternative assets are becoming increasingly attractive to investors seeking non-correlated returns or portfolio diversification. In exchange for delayed liquidity, institutional investors, high net worth individuals, and family offices have been allocating to the alternative asset classes for decades already.

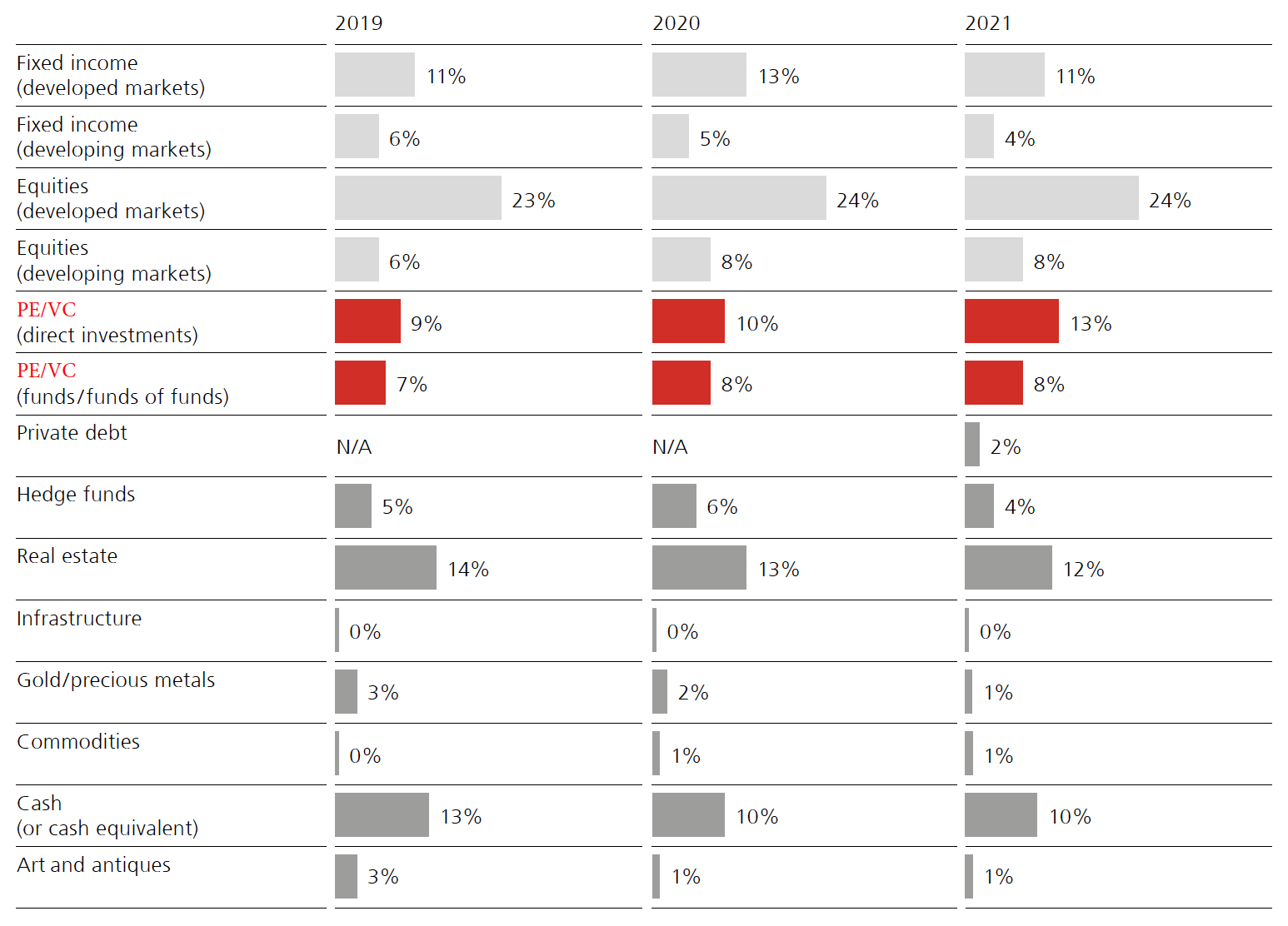

Family Offices increase their allocations to private equity and venture capital based on UBS’s 2022 Global Family Office report. It is notable that direct investments increase year-over-year since 2019 while allocations to funds and fund-of-funds stay around 8%.

Source: UBS Family Office Report 2022